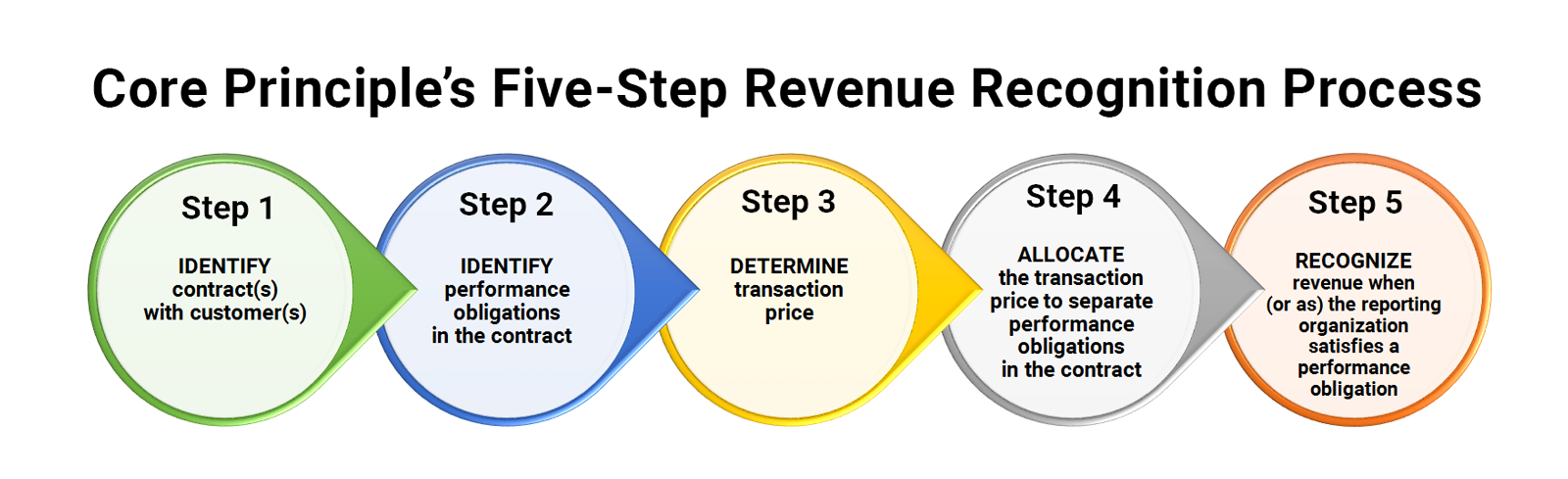

Topic 606 and Construction Revenue: What CPAs Need to Know – Accounting and Tax News & Insights Blog

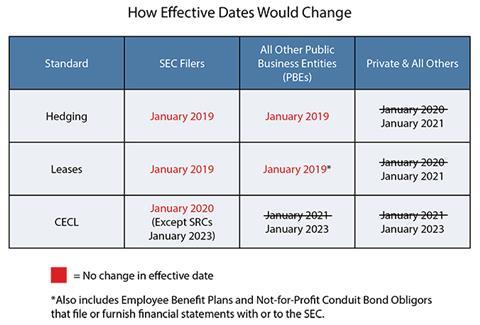

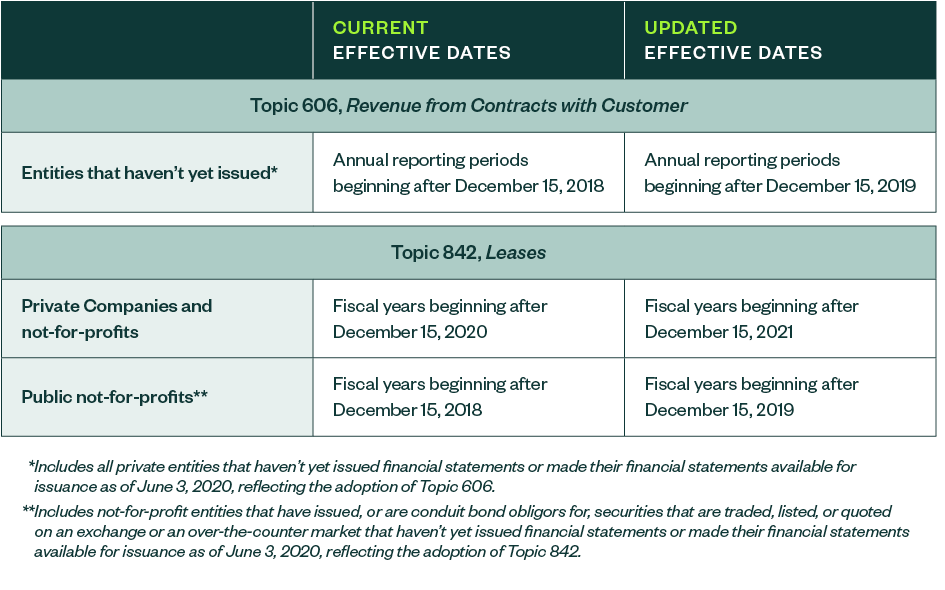

FASB Proposes Delaying Effective Date of Certain Standards Due to COVID-19 Pandemic - The CPA Journal

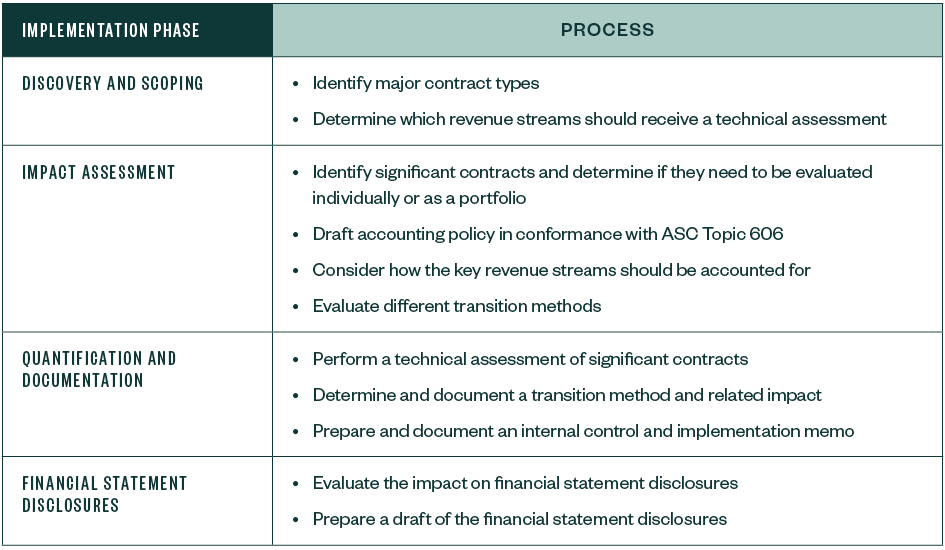

Selecting Modified Retrospective Transition for Adopting ASC 606 and Related Standards - The CPA Journal

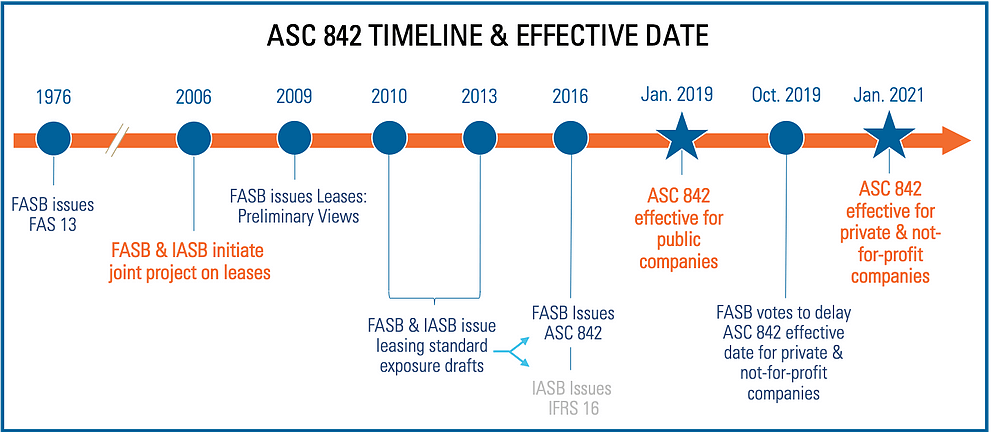

FASB directs staff to draft final ASU delaying revenue recognition and lease standard effective dates - Baker Tilly

.png.aspx?lang=en-US)